Introduction

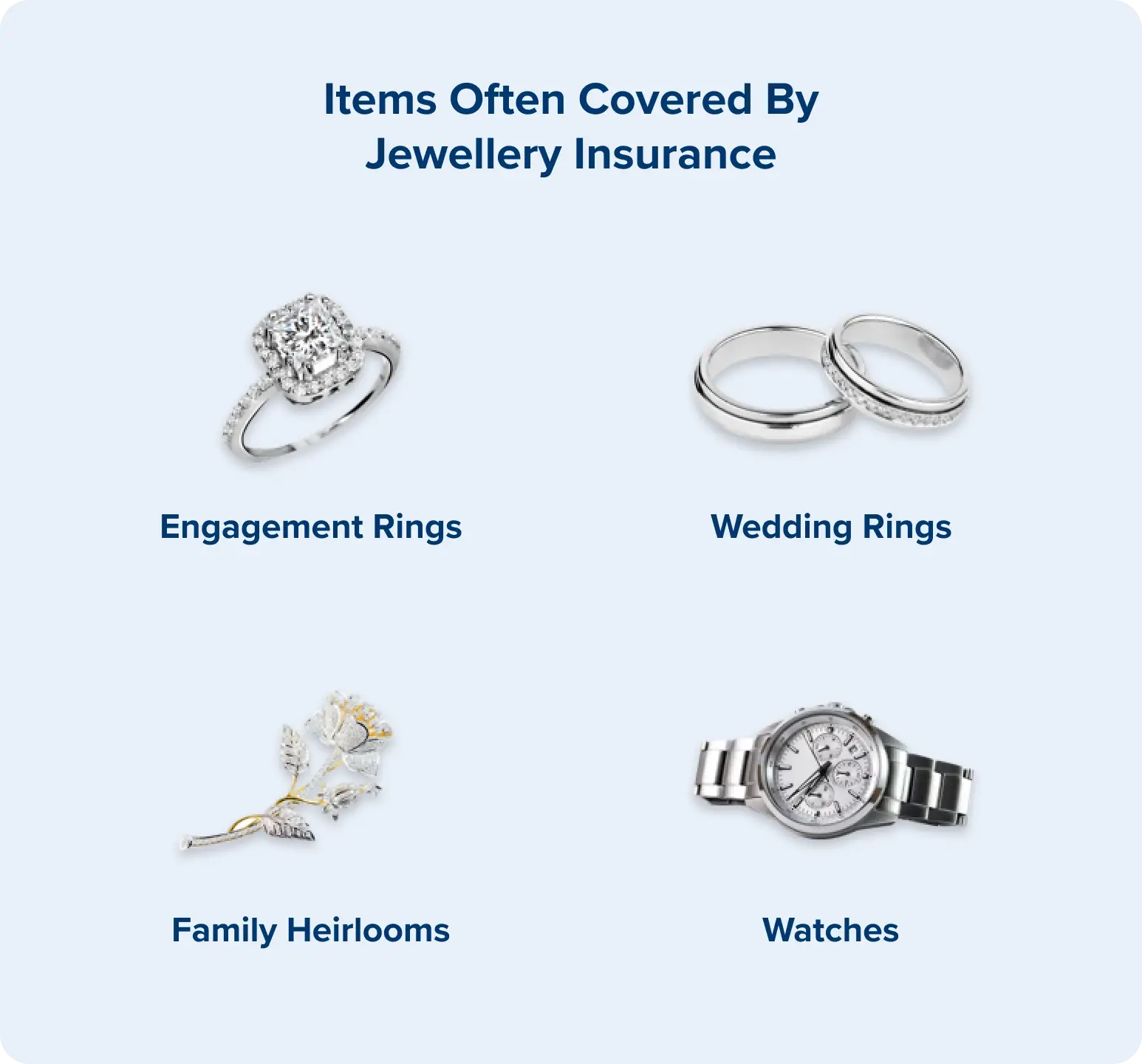

Whether it’s an engagement ring, a prized timepiece or a family heirloom passed through generations, many of us own jewellery that holds a special place in our hearts.

These are some of our most precious items; symbolising the milestones in life that define us.

Jewellery insurance is specifically designed to cover these cherished items in ways that other types of insurance may not. It provides benefits that respect the emotional distress that losing your jewellery can cause, like the option to return to your original jeweller for replacement or repair.

In this complete guide, you’ll learn the ‘how’, ‘what’ and ‘why’ of jewellery insurance, common items it covers and how it differs from other types of insurance. You’ll also learn about our acclaimed Q Report jewellery insurance policies, and how you can find the best quality cover for your needs.

Jewellery Insurance Basics

How Does Jewellery Insurance Compare?

Finding the Best Jewellery Insurance

Jewellery Insurance Basics

What is Jewellery Insurance?

Jewellery insurance is specialised cover designed just for jewellery. Just like you protect your car with car insurance, or protect yourself with travel insurance while travelling, you should protect your valuable jewellery with tailored cover.

Jewellery insurance policies provide specific benefits that take into account how you use your jewellery, and how it should be treated if it’s lost, stolen or damaged. For example, unlike some home and contents insurance policies that don’t cover your valuables outside of the home, jewellery insurance will provide cover for everyday wear.

At Q Report, our jewellery insurance policies cover your jewellery even while you travel overseas, meaning you don’t need to add expensive extra cover to your travel insurance. We’ll provide a more detailed comparison of home and contents insurance, travel insurance and jewellery insurance later in this guide

Jewellery Insurance Benefits

The benefits of your jewellery insurance will depend on the policy you choose, however, most providers offer general cover for loss, damage and theft, even while you travel overseas.

Specialised jewellery insurance providers like us offer more tailored benefits, with our Q Report policies including:

-

The option to return to your chosen jeweller for replacement or repair

-

A replacement policy

-

Free annual revaluation

-

Cover up to 150% of the insured value

-

A low fixed $100 excess

Compare these benefits with a basic home and contents insurance policy and you’ll see why thousands of Australians choose to cover their cherished jewellery with specialised providers like Q Report.

How Does it Work?

Specialised jewellery insurance policies may work differently to generic cover. Here are a few basic elements that make Q Report jewellery cover special.

Replacement Policy

In essence, our Replacement policies mean that in the event of an approved claim for a full loss, we will utilise as much of the full insured amount on your policy (less the $100 excess) as required to put you in the same position you were prior to the loss. Some policies won't pay the full amount shown on your policy if they can replace your item for less by using terminology like you are insured “up to the sum insured”. This isn’t the case when you choose a Q Report policy; we’re committed to providing the cover for a like-for-like replacement or repair, putting you back in the same position you were prior to the loss.

How to Get Jewellery Insurance

When you purchase jewellery in-store from a Q Certified Jeweller, you can request a Q Report jewellery insurance policy right there before you leave the shop. This ensures that your new prized possession can be covered before you even reach the street.

Alternatively, you can get an instant online jewellery insurance quote on our website and manage the process from home.

Revaluation

With a Q Report policy, your insured items will be revalued at no charge to you every year so you can be confident that the insured value will adequately cover you for the next year.

Making a Claim

We understand how upsetting it can be to have your jewellery lost, stolen or damaged, which is why our friendly Claims Team go above and beyond to resolve your case with sympathy and speed.

If something happens to your jewellery, all you have to do is get in touch and we’ll guide you through the process. You can return to your original jeweller for repairs or replacement, and since you have a replacement policy with our Q Report policies covering up to 150% cover, you’ll soon be reunited with your much-loved piece. But don’t take our word for it; listen to Anne’s recount of her claims experience with Q Report:

How Much Does it Cost?

The cost of your policy will depend on the insured value of your jewellery. Most insurers will require a valuation for your items and provide a quote depending on the level of cover you require.

At Q Report, if your jewellery is valued between $1,000 and $5,000, you’ll be eligible for a Q Pocket Policy. If your jewellery is valued over $5,000, you’ll be covered by our Q Classic Policy. We’ll go into more detail on our types of coverage at the end of this guide. Remember, you can get a quick online Q Report quote at any time.

How Does Jewellery Insurance Compare?

By now you may be thinking “sure, jewellery insurance sounds like a great way to protect my pieces, but can’t I get the same cover with home and contents or travel insurance?”

In this chapter, we’ll compare jewellery insurance with other common policies and ask the question; do you really need it

Jewellery Insurance vs. Home and Contents Insurance

Home and contents insurance is great for your fridge, couches and other household items. But when it comes to protecting items you take outside of the home, it often falls short. Many policies claim to offer coverage for valuables outside the home, but when it comes time to make a claim, you find that this cover is highly limited and subject to multiple exclusions. You really need to read the fine print.

In typical home and contents policies, jewellery often needs to be declared as an additional high-value item, thus raising the price of your insurance. Let’s look into some more key differences between jewellery insurance and home and contents cover.

Unlike jewellery insurance, home and contents insurance may or may not:

-

Provide comprehensive protection outside of the home

-

Provide cover without charging extra fees

-

Give you the choice to return to your chosen jeweller for replacement or repair

-

Cover your jewellery while you travel overseas

-

Keep your premiums the same after you make a claim.

You’ll need to read the fine print to find out.

This quick video provides a great outline of these key differences:

Jewellery Insurance vs. Travel Insurance

Travel insurance is a must while you explore overseas, but is it enough to protect your valuable jewellery?

Most travel insurance policies list jewellery under the baggage coverage section, which is designed to provide replacement value for items that are lost, stolen or destroyed on your trip. However, the cover limits set by travel insurers for expensive items like jewellery can be insufficient to cover the full amount of your piece.

Baggage is generally covered in the range of $500 to $3,000. Your travel insurance policy may also place a per-item limit on contents, which is where people run into trouble with their jewellery.

Like with home and contents insurance, you may be required to specify jewellery when buying your travel insurance; which will increase the cost of your policy. Let’s look at some other differences:

Unlike jewellery insurance, travel insurance may or may not:

-

Provide cover without charging extra fees

-

Give you the choice to return to your chosen jeweller for replacement or repair

-

Provide replacement cover.

Again, you really need to read the fine print or speak to your insurer.

Whether it’s a honeymoon or a family holiday, we know that people love to wear and enjoy their jewellery while they travel. That’s why with a Q Report policy, you can travel with confidence knowing your jewellery is protected with comprehensive cover.

Do You Need Jewellery Insurance?

It’s clear that when it comes to specific protection for your jewellery assets, home and contents policies and travel insurance can fall flat. But do you need to insure your items at all? Whether it’s an engagement ring, a watch or a sentimental family heirloom, there’s no clear-cut answer to this question.

However, we implore you to take a moment to really consider the value of your jewellery to you. Ask yourself, if your jewellery was lost or stolen, would you feel the same way about the loss as you would if you lost a pair of sunglasses? Losing your favourite pair of sunglasses may be irritating, but in most cases, you could just replace them in the next week or so if you wanted to. Could you just as easily replace your jewellery?

It might seem unlikely that you could let anything happen to your cherished items. But as our countless claims stories show, you never know what’s just around the corner.

Finding the Best Jewellery Insurance

Ready to take the next step in protecting your jewellery with specialised cover? In this chapter, we outline what you should look for in jewellery insurance and take a closer look at our Q Report policies.

How to Find the Best Cover

Not sure where to start when comparing policies? Here are 10 questions to ask when researching jewellery insurance companies:

-

What is the excess if I need to make a claim?

-

Can I choose where I get my jewellery replaced or repaired, or do I need to provide multiple quotes from several jewellers?

-

Do you offer free revaluation?

-

Is my jewellery covered while I travel overseas?

-

Who underwrites your insurance policy?

-

Can you provide free, instant quotes?

-

Do I deal with you directly if I need to claim, or is it a third party?

-

Do you have a history in the jewellery industry?

-

Do jewellers recommend your product?

-

Can you provide some customer testimonials?

A. $100.00

A. You are free to choose.

A. Yes, we revalue your insured items every year at no charge to you.

A. Yes, we provide global cover.

A. Chubb Insurance Australia Limited.

A. Yes, you deal with us.

A. Yes, our team are passionate jewellery lovers and we’ve worked in the industry for over 15 years.

A. Yes, we have a large network of Q Certified Jewellers who offer our services to their customers.

A. Absolutely, you can read some customer reviews on our Google page review here.

Our Jewellery Insurance Policies

At Q Report, we live and breathe jewellery, which is why we’re dedicated to providing the best value comprehensive cover for your cherished jewellery assets.

All of our Q Report policies are backed by world-leading insurer, Chubb Insurance Australia Limited. Consider our PDS and Policy Wording to see if our cover suits your needs.